Embarking on the journey of business expansion often requires strategic financial decisions, with debt financing playing a crucial role in this process. In this guide, we delve into the world of debt financing solutions for business growth, exploring the various options available and the considerations to keep in mind.

As we navigate through the intricacies of debt financing, you will gain valuable insights into how businesses can leverage this funding method to achieve their expansion goals effectively.

Overview of Debt Financing Solutions

Debt financing is a common strategy used by businesses to fund their expansion projects or operations. It involves borrowing money from lenders or financial institutions that must be repaid over a period of time with interest. This type of financing allows businesses to access capital without giving up ownership or control of their company.

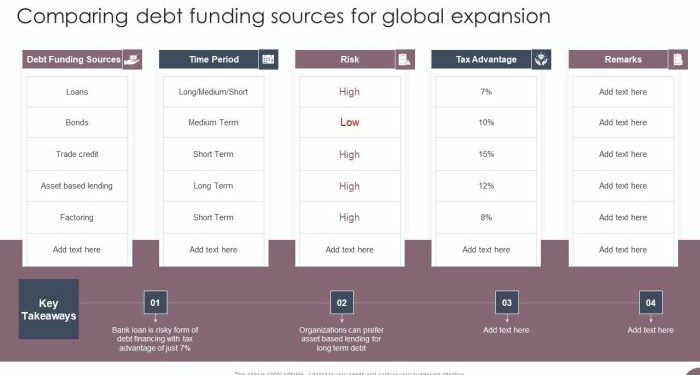

Types of Debt Financing Options

- Bank Loans: Traditional loans provided by banks with fixed interest rates and repayment terms.

- Lines of Credit: Flexible borrowing arrangements that allow businesses to access funds as needed.

- Bonds: Debt securities issued by companies to raise capital, with fixed interest payments to bondholders.

- Asset-Based Lending: Loans secured by the company's assets, such as inventory or equipment.

Advantages and Disadvantages of Debt Financing

Debt financing offers several benefits for businesses, such as:

- Retaining ownership and control of the company.

- Interest payments on debt are tax-deductible.

- Fixed repayment terms, making it easier to budget and plan for payments.

However, there are also disadvantages to consider:

- High-interest costs can increase the overall debt burden.

- Defaulting on debt payments can lead to severe consequences, such as asset seizure.

- Debt obligations can limit future financial flexibility and borrowing capacity.

Common Sources of Debt Financing

Debt financing is a common way for businesses to raise capital for expansion and growth. There are various sources of debt financing available, each with its own terms and requirements.

Traditional Sources of Debt Financing

- Bank Loans: Banks offer loans to businesses based on creditworthiness and collateral. These loans typically have fixed interest rates and repayment terms.

- Credit Unions: Credit unions are another traditional source of debt financing for businesses. They often offer lower interest rates than banks and may be more flexible in their lending criteria.

Alternative Sources of Debt Financing

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect businesses with individual investors willing to lend money. This option can sometimes offer lower interest rates and faster approval processes.

- Online Lenders: Online lending platforms have become popular for businesses seeking quick and convenient access to financing. These lenders may have less stringent requirements than traditional financial institutions.

Comparison of Terms and Requirements

| Source | Interest Rates | Collateral Requirements | Approval Process |

|---|---|---|---|

| Bank Loans | Fixed, based on credit rating | Often required | Lengthy approval process |

| Credit Unions | Variable, may be lower | May be flexible | More personalized approach |

| Peer-to-Peer Lending | Varies, competitive rates | May be less stringent | Quick approval |

| Online Lenders | Varies, may be higher | Varies, may not always require collateral | Fast approval process |

Factors to Consider Before Choosing a Debt Financing Solution

Before opting for a debt financing solution, businesses should carefully evaluate various factors to ensure they make the right choice that aligns with their financial goals and capabilities.

Assessing the Business's Financial Health

One of the most crucial factors to consider before choosing a debt financing solution is the current financial health of the business. It is essential to review the company's balance sheet, income statement, and cash flow projections to determine its ability to take on debt and meet repayment obligations.

- Evaluate the company's revenue trends and profitability to ensure it can generate sufficient cash flow to cover debt payments.

- Consider the existing debt obligations and debt-to-equity ratio to understand the company's leverage and capacity for additional debt.

- Review the business's credit score and credit history to assess its creditworthiness in the eyes of lenders.

Interest Rates, Repayment Terms, and Collateral Requirements

When evaluating debt financing options, businesses need to pay close attention to key terms that can significantly impact the cost and risks associated with the debt.

- Interest Rates: Compare the interest rates offered by different lenders and understand how they will affect the total cost of borrowing over time.

- Repayment Terms: Consider the repayment schedule, including the frequency of payments and the duration of the loan, to ensure it aligns with the business's cash flow.

- Collateral Requirements: Determine whether the lender requires collateral to secure the loan and assess the implications of providing assets as security.

Case Studies of Successful Business Expansions Using Debt Financing

Debt financing has been a vital tool for many businesses looking to expand their operations and reach new heights. Let's delve into some real-life examples of successful business expansions achieved through debt financing.

Case Study 1: XYZ Tech Company

XYZ Tech Company, a startup in the tech industry, decided to expand its product line and market reach by securing a substantial loan from a financial institution. With the infusion of funds, the company was able to develop new cutting-edge technologies, hire top talent, and launch an aggressive marketing campaign.

This strategic move resulted in a significant increase in sales and market share, propelling XYZ Tech Company to become a key player in the industry.

Case Study 2: ABC Restaurant Chain

ABC Restaurant Chain, a popular dining franchise, utilized debt financing to open multiple new locations across different cities. By taking on loans to cover the costs of real estate, equipment, and initial operating expenses, the restaurant chain was able to rapidly expand its footprint and attract a larger customer base.

Through careful financial planning and efficient management of resources, ABC Restaurant Chain achieved profitability in each new location within a short period of time.

Case Study 3: LMN Manufacturing Co.

LMN Manufacturing Co., a long-established player in the manufacturing sector, sought debt financing to upgrade its production facilities and enhance its product offerings. By leveraging loans to invest in state-of-the-art machinery and technology, the company was able to streamline its operations, increase efficiency, and meet growing demand.

This strategic decision not only boosted LMN Manufacturing Co.'s revenue but also solidified its position as an industry leader.

Last Word

In conclusion, debt financing presents a viable pathway for businesses looking to expand their operations and reach new heights of success. By understanding the nuances of debt financing solutions, companies can make informed decisions that propel them towards sustainable growth and prosperity.

Essential FAQs

What are the key advantages of debt financing for business expansion?

Debt financing can provide businesses with access to large sums of capital quickly, allowing for rapid expansion and growth opportunities that may not be feasible with other funding sources.

How does credit history impact eligibility for debt financing?

A strong credit history can increase the likelihood of approval for debt financing and may also lead to more favorable terms and interest rates. Poor credit history, on the other hand, can limit options and result in higher costs.

What steps can businesses take to prepare for debt financing?

Businesses can improve their chances of securing debt financing by organizing financial documents, developing a clear business plan, and assessing their ability to comfortably manage debt repayments.