Starting off with Best Debt Consolidation Loans With Competitive Interest Rates, this opening paragraph aims to grab the attention of readers by providing a brief yet intriguing overview of the topic.

The next paragraph will delve deeper into the details of the subject matter.

Understanding Debt Consolidation Loans

Debt consolidation is a financial strategy where multiple debts are combined into a single loan with a lower interest rate. This can help simplify payments and potentially save money in the long run.

How Debt Consolidation Loans Work

Debt consolidation loans work by taking out a new loan to pay off existing debts. This new loan typically has a lower interest rate, making it easier to manage monthly payments. By consolidating debts, individuals can streamline their finances and focus on paying off one loan instead of juggling multiple payments.

- Individuals can choose to consolidate various types of debt, such as credit card balances, personal loans, medical bills, or other outstanding debts.

- The new loan amount is used to pay off the existing debts, leaving only one loan with a fixed monthly payment.

- By consolidating debts, borrowers may benefit from a lower overall interest rate, potentially reducing the total amount paid over time.

Examples of Situations Where Debt Consolidation Loans are Beneficial

Debt consolidation loans can be beneficial in various situations, such as:

- Managing high-interest credit card debt: By consolidating credit card balances into a single loan with a lower interest rate, individuals can save money on interest payments.

- Streamlining finances: Combining multiple debts into one loan can simplify payments and help individuals stay organized with their finances.

- Improving credit score: Making consistent payments on a debt consolidation loan can help improve credit scores over time, as long as payments are made on time and in full.

Factors to Consider When Choosing a Debt Consolidation Loan

When selecting a debt consolidation loan, there are several key factors to consider to ensure you make the best decision for your financial situation.Interest rates play a crucial role in debt consolidation as they determine the overall cost of the loan and how much you will end up paying in the long run.

It is essential to compare interest rates offered by different lenders to find a loan with competitive rates that suit your budget.

Fixed vs. Variable Interest Rates

When exploring loan options, you will come across fixed and variable interest rates. Understanding the difference between the two can help you make an informed decision:

- Fixed Interest Rates:With a fixed interest rate, your monthly payments remain the same throughout the loan term. This provides stability and predictability, making it easier to budget and plan for repayments.

- Variable Interest Rates:Variable interest rates can fluctuate based on market conditions, which means your monthly payments may change over time. While initial rates may be lower, there is a risk of facing higher payments in the future.

It is important to consider your risk tolerance and financial goals when choosing between fixed and variable interest rates for your debt consolidation loan.

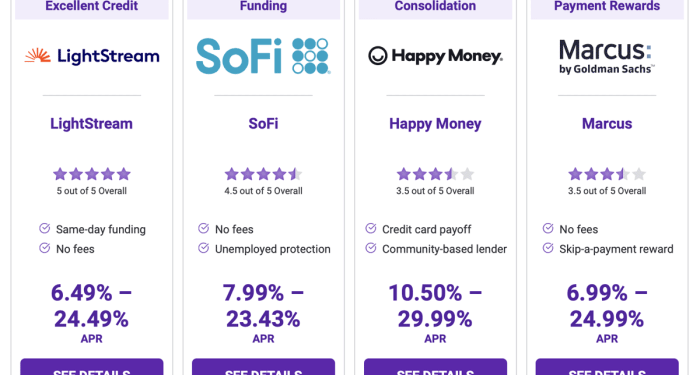

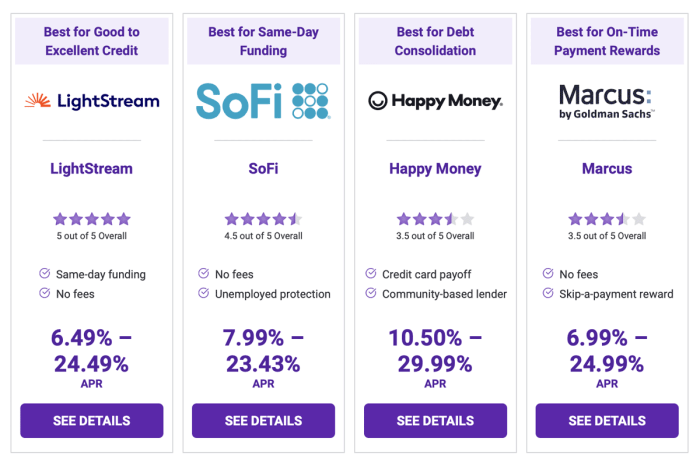

Finding the Best Debt Consolidation Loans

When looking for the best debt consolidation loans, it is essential to consider reputable financial institutions that offer competitive interest rates. Researching and comparing interest rates will help you find the most suitable option for your financial needs. Additionally, negotiating for competitive interest rates can potentially save you money in the long run.

Reputable Financial Institutions Offering Debt Consolidation Loans

- Bank of America

- Wells Fargo

- Discover

- SoFi

Researching and Comparing Interest Rates

- Check multiple lenders to compare interest rates and terms.

- Use online tools and calculators to estimate monthly payments.

- Consider the APR (Annual Percentage Rate) to get a comprehensive view of the total cost.

- Read customer reviews and testimonials to gauge the lender's reputation.

Negotiating for Competitive Interest Rates

- Highlight your good credit score and financial stability to negotiate for lower interest rates.

- Be prepared to provide documentation of your income and expenses to support your case.

- Compare offers from different lenders and use them as leverage in negotiations.

- Consider working with a credit counselor or financial advisor for assistance in negotiating with lenders.

Benefits of Competitive Interest Rates in Debt Consolidation Loans

When it comes to debt consolidation loans, securing a loan with competitive interest rates can offer a range of benefits that can significantly impact your financial situation. Lower interest rates can lead to substantial savings in the long term and can make a significant difference in the total cost of your loan.

Advantages of Competitive Interest Rates

- Lower Monthly Payments: By securing a debt consolidation loan with competitive interest rates, you can enjoy lower monthly payments, making it easier to manage your finances and stay on top of your debt repayment.

- Reduced Total Interest: Lower interest rates mean less interest accrues over the life of the loan, resulting in a reduced total amount paid back. This can save you a significant amount of money over time.

- Faster Debt Repayment: With lower interest rates, more of your monthly payment goes towards paying off the principal balance rather than interest, helping you pay off your debt faster.

Impact of Interest Rates on Total Loan Cost

Interest rates play a crucial role in determining the total cost of a loan. Even a small difference in interest rates can have a substantial impact on the amount you end up paying back. For example, let's consider two scenarios:

Scenario 1: You have a $20,000 debt consolidation loan with a 10% interest rate over 5 years.Total Interest Paid = $20,000 x 10% = $2,000Total Amount Paid Back = $20,000 + $2,000 = $22,000

Scenario 2: The same $20,000 debt consolidation loan with a 7% interest rate over 5 years.Total Interest Paid = $20,000 x 7% = $1,400Total Amount Paid Back = $20,000 + $1,400 = $21,400

As seen in the examples above, a lower interest rate can lead to significant savings over the life of the loan, making it crucial to secure a debt consolidation loan with competitive interest rates.

Last Recap

Wrapping up the discussion on Best Debt Consolidation Loans With Competitive Interest Rates, this final paragraph summarizes the key points in a compelling way.

FAQs

What are some key factors to consider when choosing a debt consolidation loan?

Some key factors to consider include interest rates, fees, repayment terms, and the reputation of the lender.

How can I find reputable financial institutions offering debt consolidation loans?

You can research online, read reviews, and check with local credit unions or banks known for their loan services.

Why are competitive interest rates important in debt consolidation loans?

Competitive interest rates can save you money in the long run by reducing the overall cost of borrowing.