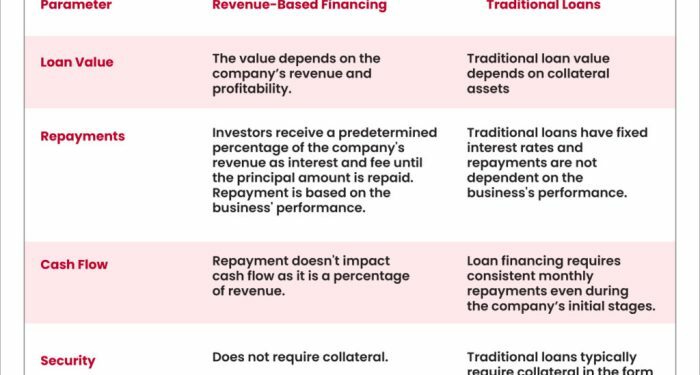

Exploring the differences between Revenue Based Financing and Traditional Business Loans sheds light on the varying financial strategies available to businesses. This comparison delves into the intricacies of funding options, offering valuable insights for decision-making.

As we delve deeper into the specifics of each financing method, a clearer picture emerges of how businesses can navigate the complex landscape of financial support.

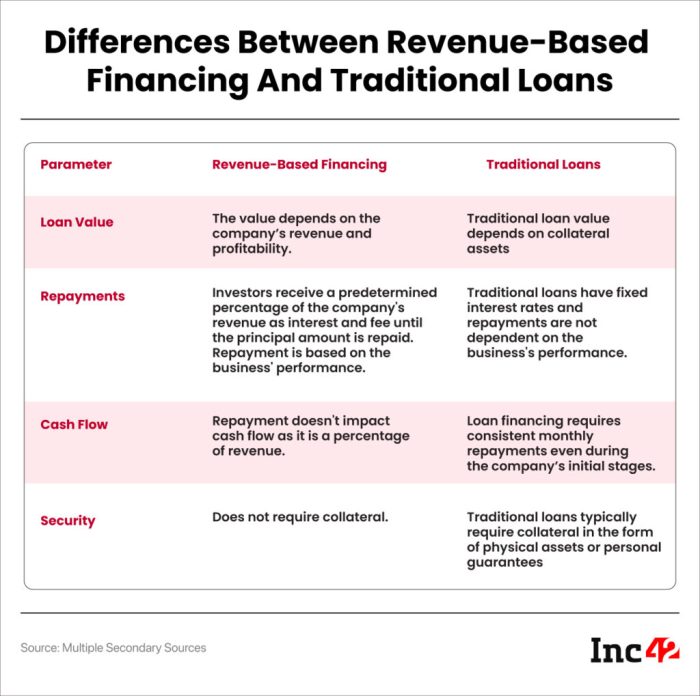

Revenue Based Financing vs Traditional Business Loans

Revenue-based financing is a type of funding where a business receives capital in exchange for a percentage of its future revenues. This means that repayments are directly tied to the company's revenue, making it a flexible option for businesses with fluctuating income.

Key Characteristics of Traditional Business Loans

Traditional business loans involve borrowing a fixed amount of money from a lender and repaying it with interest over a set period of time. These loans typically require collateral and have fixed monthly payments, regardless of the business's revenue.

Eligibility Criteria Comparison

Revenue-based financing

Focuses more on the business's revenue stream and growth potential rather than credit score or collateral.

Suitable for businesses with consistent revenue but may not qualify for traditional loans.

Traditional business loans

Require collateral and a good credit score for approval.

Best suited for established businesses with a solid financial history.

Examples of Industries Suited for Each

Revenue-based financing

Start-ups with high growth potential but limited collateral.

Seasonal businesses with fluctuating revenue streams.

Traditional business loans

Established businesses looking to expand or purchase assets.

Industries with stable cash flow and reliable revenue projections.

Terms and Conditions

Revenue-based financing and traditional business loans come with their own set of terms and conditions that can significantly impact the overall cost of financing for businesses. Let's explore the key differences in terms and conditions between these two financing options.

Terms and Conditions of Revenue-Based Financing

Revenue-based financing typically involves a percentage of a business's future revenue being used to repay the financing. The terms and conditions of revenue-based financing may include:

- Repayment Structure: Instead of fixed monthly payments, repayments are based on a percentage of the business's revenue. This means that during slower months, the repayment amount decreases, providing some flexibility for businesses.

- Term Length: The term length of revenue-based financing is often shorter compared to traditional loans, ranging from 6 months to 5 years.

- Interest Rates: Revenue-based financing may have higher effective interest rates compared to traditional loans, as the repayment is based on a percentage of revenue rather than a fixed interest rate.

- Covenants: Revenue-based financing may have fewer financial covenants compared to traditional loans, making it a more flexible option for businesses.

Terms and Conditions of Traditional Business Loans

Traditional business loans have different terms and conditions compared to revenue-based financing:

- Repayment Structure: Traditional business loans typically have fixed monthly payments, regardless of the business's revenue fluctuations.

- Term Length: The term length of traditional business loans can vary from 1 to 30 years, providing businesses with longer repayment periods.

- Interest Rates: Traditional business loans may offer lower interest rates compared to revenue-based financing, especially for businesses with strong credit profiles.

- Covenants: Traditional business loans often come with strict financial covenants that businesses must adhere to, which can limit flexibility.

Flexibility of Terms and Conditions

In terms of flexibility, revenue-based financing offers more flexibility in repayment structures and covenants compared to traditional business loans. This flexibility can be beneficial for businesses that experience seasonal fluctuations in revenue or have unpredictable cash flows. On the other hand, traditional business loans provide businesses with longer repayment terms and potentially lower interest rates, but come with stricter covenants that may limit operational freedom.

Impact on Overall Cost of Financing

The terms and conditions of revenue-based financing and traditional business loans directly impact the overall cost of financing for businesses. While revenue-based financing may have higher effective interest rates, the flexibility in repayment structures can help businesses manage cash flow during challenging times.

On the other hand, traditional business loans with lower interest rates may come with stricter covenants that could increase operational risks for businesses. It is essential for businesses to carefully consider the terms and conditions of both financing options to choose the one that best aligns with their financial needs and growth plans.

Application Process

When it comes to applying for financing, the process can vary significantly depending on the type of funding you choose. Here, we will delve into the application process for revenue-based financing and traditional business loans, comparing and contrasting their documentation requirements, approval speed, and funding processes.

Revenue-Based Financing Application Process

- Start by submitting an online application with details about your business, revenue projections, and funding needs.

- Provide financial statements and bank statements to support your revenue claims.

- Undergo a due diligence process where the financing provider assesses your business's financial health and revenue potential.

- If approved, you receive a term sheet outlining the terms of the financing agreement.

Documentation Requirements Comparison

- Revenue-Based Financing:Typically requires minimal documentation focused on revenue history and projections.

- Traditional Business Loans:Require extensive documentation including business plans, tax returns, collateral, and financial statements.

Speed of Approval and Funding

- Revenue-Based Financing:Approval and funding can be quicker compared to traditional loans due to the focus on revenue performance.

- Traditional Business Loans:Approval can take weeks or even months, with funding timelines varying based on the lender.

Tips for Navigating the Application Process

- Organize your financial documents in advance to expedite the application process.

- Be prepared to provide detailed information about your business's revenue history and projections.

- Research different financing options to find the best fit for your business's needs and growth plans.

- Communicate openly with the financing provider to address any questions or concerns they may have during the due diligence process.

Risk Management

When it comes to funding options for businesses, understanding and managing risks is crucial. In this section, we will explore the risks associated with revenue-based financing, analyze risk mitigation strategies, compare risk exposure with traditional business loans, and provide recommendations for effective risk management.

Risks Associated with Revenue-Based Financing

- Variable Payments: Since repayments are based on a percentage of revenue, fluctuations in revenue can impact the ability to make payments.

- Longer Payback Period: Revenue-based financing may have a longer payback period compared to traditional loans, leading to higher overall costs.

- Loss of Control: Investors in revenue-based financing may have a claim on a portion of future revenues, potentially impacting business decisions.

Risk Mitigation Strategies for Revenue-Based Financing

- Diversify Revenue Streams: Having multiple sources of revenue can help mitigate the impact of fluctuations in one particular revenue stream.

- Regular Financial Monitoring: Keeping a close eye on financial performance can help identify any issues early on and take corrective action.

- Negotiate Flexible Terms: Businesses can negotiate for flexible repayment terms based on revenue performance to manage payment fluctuations.

Comparison of Risk Exposure

- Revenue-based financing tends to have a lower risk of default compared to traditional loans, as repayments are directly tied to revenue.

- Traditional loans may have stricter collateral requirements, posing a higher risk of asset seizure in case of default.

- However, revenue-based financing may expose the business to potential loss of control over decision-making due to investor involvement.

Recommendations for Effective Risk Management

- Understand the Terms: Businesses should thoroughly understand the terms and conditions of both revenue-based financing and traditional loans before making a decision.

- Assess Risk Tolerance: Evaluate the business's risk tolerance and financial stability to determine the most suitable funding option.

- Seek Professional Advice: Consulting with financial advisors or legal experts can provide valuable insights into the risks and benefits of each financing option.

Concluding Remarks

In conclusion, understanding the nuances between Revenue Based Financing and Traditional Business Loans equips businesses with the knowledge needed to make informed choices. By weighing the pros and cons of each option, organizations can tailor their financial approach to suit their unique needs and objectives.

Helpful Answers

What are the main differences between Revenue Based Financing and Traditional Business Loans?

Revenue Based Financing relies on a percentage of a company's future revenue, while Traditional Business Loans involve a lump sum borrowed with interest.

Which industries are better suited for Revenue Based Financing over Traditional Business Loans?

Startups or businesses with fluctuating revenue streams may find Revenue Based Financing more suitable due to its flexible repayment structure.

How do terms and conditions impact the overall cost of financing for businesses?

The terms and conditions dictate the repayment schedule and interest rates, directly influencing the total cost of financing for businesses.

What are the key risks associated with Revenue Based Financing?

Risks include potential higher costs over time compared to traditional loans, especially if the business experiences rapid revenue growth.