Exploring the differences between Credit Card Consolidation Loans and Balance Transfer Cards, this discussion aims to provide valuable insights for individuals seeking to manage their credit card debt effectively. By delving into the benefits, drawbacks, and practical tips associated with each option, readers can make informed decisions regarding their financial well-being.

In the following paragraphs, we will dissect the key aspects of Credit Card Consolidation Loans and Balance Transfer Cards to help you navigate the complexities of debt consolidation effortlessly.

Credit Card Consolidation Loan

When facing overwhelming credit card debt, a credit card consolidation loan can be a helpful financial tool. This type of loan allows individuals to combine multiple high-interest debts into a single, more manageable loan with a lower interest rate.

Benefits of Credit Card Consolidation Loan

- Lower Interest Rate: By consolidating debt into a single loan, individuals can potentially secure a lower interest rate compared to the rates on their credit cards.

- Simplified Payments: With only one monthly payment to make, it can be easier to manage finances and stay on top of repayments.

- Fixed Repayment Schedule: Credit card consolidation loans often come with a fixed repayment schedule, providing predictability and structure for debt repayment.

Potential Drawbacks of Credit Card Consolidation Loan

- Extended Repayment Period: While a lower interest rate can be advantageous, extending the repayment period may result in paying more interest over time.

- Collateral Requirement: Some credit card consolidation loans may require collateral, such as a home or car, putting those assets at risk if unable to repay the loan.

- Impact on Credit Score: Applying for a new loan can temporarily lower the credit score, but timely repayments can help improve it over time.

Situations Suitable for Credit Card Consolidation Loan

- High-Interest Credit Card Debt: Individuals with multiple credit card debts carrying high-interest rates may benefit from consolidating into a single loan with a lower rate.

- Desire for Simplified Payments: For those looking to streamline their debt repayment process and reduce the number of monthly payments to manage.

- Financial Discipline: Consolidation loans can be a good option for individuals committed to improving their financial habits and working towards debt freedom.

Balance Transfer Cards

Balance transfer cards are credit cards that allow you to transfer existing balances from other credit cards onto them. These cards typically offer a low or 0% introductory APR for a certain period, making them an attractive option for consolidating credit card debt.

Benefits of Balance Transfer Cards

- Lower Interest Rates: Balance transfer cards often come with a lower introductory APR compared to the interest rates on traditional credit cards, helping you save money on interest payments.

- Consolidation of Debt: By transferring multiple balances onto one card, you can streamline your payments and potentially pay off your debt faster.

- Introductory Promotions: Some balance transfer cards offer perks like cashback rewards or waived balance transfer fees, providing additional savings opportunities.

Disadvantages of Balance Transfer Cards

- Balance Transfer Fees: While some cards offer waived fees, others may charge a percentage of the transferred balance as a fee, impacting the overall savings.

- Short Introductory Periods: The low or 0% APR period is temporary, and once it expires, the interest rates may increase significantly, potentially leading to higher costs.

- New Debt Temptation: Having a new credit card with available credit may tempt you to incur more debt, negating the purpose of debt consolidation.

Tips for Using Balance Transfer Cards Effectively

- Choose the Right Card: Look for a balance transfer card with a long introductory period and low fees to maximize your savings.

- Create a Repayment Plan: Develop a budget and repayment strategy to ensure you can pay off the transferred balance before the introductory period ends.

- Avoid New Charges: Refrain from using the balance transfer card for new purchases to prevent accumulating more debt and focus on paying off existing balances.

Interest Rates and Fees

When considering credit card consolidation loans versus balance transfer cards, understanding the differences in interest rates and fees is crucial to making an informed decision. Let's delve into the details to help you navigate the financial landscape.

Interest Rates

Credit card consolidation loans typically offer fixed interest rates, which remain constant throughout the repayment period. On the other hand, balance transfer cards often come with introductory 0% APR promotions for a limited time, after which the rates can significantly increase.

It's essential to compare the long-term implications of these rates to choose the most cost-effective option.

Fees

Both credit card consolidation loans and balance transfer cards may have associated fees. Credit card consolidation loans can come with origination fees, late payment fees, or prepayment penalties. Balance transfer cards may charge balance transfer fees, typically ranging from 3% to 5% of the transferred amount.

Understanding these fees is crucial in determining the overall cost of consolidating your credit card debt.

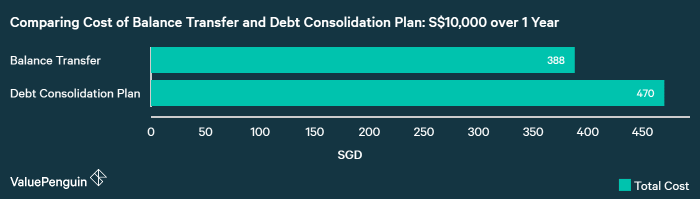

Comparing Costs

When comparing the overall cost implications of credit card consolidation loans and balance transfer cards, consider not only the interest rates but also the associated fees. While balance transfer cards may offer a temporary reprieve with 0% APR, the potential for higher rates after the promotional period ends can lead to increased costs.

Credit card consolidation loans, with their fixed rates, provide more stability in long-term planning.

Minimizing Payments and Fees

To minimize interest payments and fees when consolidating credit card debt, consider negotiating lower interest rates with lenders or opting for balance transfer cards with low or no transfer fees. Making timely payments and avoiding additional charges can also help reduce overall costs.

Prioritize paying off the consolidated debt efficiently to avoid accruing more interest over time.

Eligibility and Application Process

When it comes to obtaining a credit card consolidation loan or applying for a balance transfer card, understanding the eligibility criteria and application process is crucial. Let's delve into the details.

Eligibility for Credit Card Consolidation Loan

To be eligible for a credit card consolidation loan, lenders typically look for a few key factors:

- A good credit score: Most lenders require a credit score of 600 or higher to qualify for a consolidation loan.

- Stable income: Lenders want to see that you have a stable source of income to ensure you can repay the loan.

- Low debt-to-income ratio: A lower debt-to-income ratio indicates that you have the financial capacity to take on additional debt.

Application Process for Credit Card Consolidation Loans

The application process for a credit card consolidation loan usually involves the following steps:

- Research and compare lenders to find the best loan terms.

- Complete an online application with personal and financial information.

- Submit necessary documentation such as pay stubs, bank statements, and credit card statements.

- Wait for approval and review the loan terms before accepting the offer.

Eligibility for Balance Transfer Cards

Balance transfer cards have different eligibility requirements compared to consolidation loans. Some common criteria include:

- Good to excellent credit score: Most balance transfer cards require a credit score of 670 or higher.

- No recent late payments: Lenders prefer applicants with a history of on-time payments.

- Low credit card utilization: A lower credit card utilization ratio indicates responsible credit management.

Application Process for Balance Transfer Cards

The application process for balance transfer cards is relatively straightforward:

- Choose a balance transfer card that suits your needs and offers a favorable introductory APR.

- Complete the online application with personal and financial details.

- Wait for approval and receive your new card in the mail.

- Transfer balances from high-interest credit cards to your new balance transfer card.

Tips for Improving Eligibility

To boost your chances of approval for a credit card consolidation loan or a balance transfer card, consider the following tips:

- Improve your credit score by making on-time payments and reducing outstanding debt.

- Review your credit report for errors and dispute any inaccuracies to help raise your score.

- Lower your debt-to-income ratio by paying down existing debts before applying for new credit.

- Shop around and compare offers from different lenders or card issuers to find the best terms for your financial situation.

Ultimate Conclusion

In conclusion, understanding the nuances of Credit Card Consolidation Loans and Balance Transfer Cards is crucial in devising a strategic approach towards debt management. By weighing the advantages and disadvantages Artikeld in this discussion, individuals can tailor their financial strategies to suit their specific needs and goals.

Commonly Asked Questions

What are the main benefits of opting for a Credit Card Consolidation Loan over Balance Transfer Cards?

Answer: Credit Card Consolidation Loans typically offer lower interest rates and fixed repayment terms, providing a structured approach to debt repayment.

How do Balance Transfer Cards differ from Credit Card Consolidation Loans in terms of overall cost implications?

Answer: While Balance Transfer Cards may offer introductory 0% APR periods, the long-term cost can be higher due to potential high-interest rates post-introductory period.

What strategies can be employed to minimize interest payments and fees when consolidating credit card debt?

Answer: It is advisable to compare offers, negotiate for lower rates, and create a realistic repayment plan to reduce interest payments and fees during debt consolidation.

Are there specific eligibility requirements for applying for a Balance Transfer Card?

Answer: Eligibility for a Balance Transfer Card often depends on credit score, existing debt levels, and the issuer's criteria for approval.