Delve into the world of credit consolidation mistakes to steer clear of financial pitfalls. From common errors to smart strategies, this guide offers valuable insights to help you navigate the process with confidence.

Learn how to avoid the most prevalent mistakes and make informed decisions that benefit your financial well-being.

Common Credit Consolidation Mistakes

When it comes to consolidating credit, there are several common mistakes that people often make, which can have serious consequences on their financial health.

1. Ignoring Interest Rates

One of the top mistakes people make when consolidating credit is ignoring the interest rates associated with the new loan or credit card. Failing to compare and consider the interest rates can lead to higher overall costs in the long run.

2. Not Checking Fees and Penalties

Another mistake is not paying attention to any fees or penalties that may be involved in the consolidation process. These additional costs can add up quickly and negate any potential savings from consolidating.

3. Closing Old Accounts

Some individuals make the error of closing their old credit accounts after consolidating, thinking it will improve their credit score. However, this can actually harm their credit utilization ratio and lower their credit score instead.

4. Taking on More Debt

One common mistake is taking on more debt once the original debts have been consolidated. This can lead to a cycle of debt accumulation and make it harder to achieve financial stability in the future.

5. Not Having a Repayment Plan

Lastly, not having a clear repayment plan in place after consolidating credit can result in missed payments and increased interest charges. It is essential to have a budget and repayment strategy to avoid falling back into debt.

Choosing the Right Consolidation Method

When it comes to choosing the right credit consolidation method, it's essential to understand the different options available, along with their pros and cons. Selecting the most suitable method can have a significant impact on your financial situation and debt repayment journey.

Balance Transfer Credit Card

- Pros:

- Introductory low or 0% APR for a certain period

- Can consolidate multiple credit card balances into one

- Cons:

- High APR after introductory period

- Balance transfer fees may apply

Debt Consolidation Loan

- Pros:

- Fixed interest rate for the term of the loan

- Single monthly payment for all debts

- Cons:

- May require collateral for a lower interest rate

- Longer repayment term can result in paying more interest

Debt Management Plan

- Pros:

- Professional assistance in creating a repayment plan

- Negotiation with creditors to reduce interest rates or fees

- Cons:

- May impact credit score in the short term

- Monthly payments may need to be made to a third-party agency

Home Equity Loan or Line of Credit

- Pros:

- Lower interest rates compared to other methods

- Potential tax benefits on interest payments

- Cons:

- Your home is used as collateral

- Risk of foreclosure if payments are not made

Choosing the Most Suitable Method

Before selecting a credit consolidation method, it's crucial to assess your financial situation, including your credit score, outstanding debts, and repayment ability. Consider the interest rates, fees, and potential impact on your credit score for each method. Compare the pros and cons to determine which option aligns best with your financial goals and capabilities.

Understanding Interest Rates and Fees

When it comes to credit consolidation, understanding interest rates and fees is crucial for managing your finances effectively. Let's delve into how these factors can impact your consolidation process.

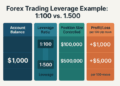

Impact of Interest Rates on Credit Consolidation

Interest rates play a significant role in determining the overall cost of your consolidated loan. Higher interest rates can result in you paying more over time, so it's essential to secure a low interest rate when consolidating your debts.

Common Fees Associated with Credit Consolidation

There are various fees that may be associated with credit consolidation, such as origination fees, balance transfer fees, and prepayment penalties. These fees can add to the total cost of your consolidation, so it's important to be aware of them before committing to a consolidation plan.

Strategies to Minimize Interest Payments and Fees

- Compare interest rates from different lenders to find the most favorable terms.

- Avoid taking on new debt while consolidating to prevent additional fees.

- Look for consolidation options with no origination fees or prepayment penalties to reduce costs.

- Create a budget and payment plan to ensure you can make timely payments and minimize interest charges.

Importance of Budgeting After Consolidation

Creating a budget after consolidating credit is crucial to ensure financial stability and prevent falling back into debt. By managing finances effectively post-consolidation, individuals can maintain control over their spending and savings, ultimately achieving long-term financial goals.

Tips for Effective Financial Management

- Track expenses: Keep a detailed record of all expenses to identify spending patterns and areas where costs can be reduced.

- Set financial goals: Establish short-term and long-term financial goals to stay motivated and focused on saving and reducing debt.

- Create a budget: Develop a realistic budget that allocates funds for essential expenses, debt payments, savings, and discretionary spending.

- Monitor progress: Regularly review and adjust the budget to ensure that financial goals are being met and to address any unexpected expenses.

Avoiding Debt Relapse

- Avoid unnecessary credit card use: Limit the use of credit cards to prevent accumulating new debt and worsening financial situations.

- Build an emergency fund: Save a portion of income in an emergency fund to cover unexpected expenses and avoid relying on credit in times of crisis.

- Seek financial guidance: Consult with financial advisors or credit counselors to receive guidance on managing finances and staying debt-free.

- Practice financial discipline: Cultivate good financial habits such as saving regularly, avoiding impulse purchases, and living within means to maintain financial stability.

End of Discussion

As we conclude our exploration of credit consolidation mistakes to avoid, remember that knowledge is power when it comes to managing your finances. By sidestepping these pitfalls and embracing sound financial practices, you can pave the way for a more secure financial future.

Questions Often Asked

What are the consequences of common credit consolidation mistakes?

Common mistakes can lead to increased debt, higher interest payments, and longer repayment terms, ultimately impacting your financial health negatively.

How do interest rates affect credit consolidation?

Interest rates play a crucial role in determining the cost of credit consolidation. Higher rates can result in more expensive consolidation, while lower rates can lead to savings.

Why is budgeting important after consolidating credit?

Creating a budget post-consolidation helps you track expenses, avoid overspending, and stay on top of your financial goals, preventing a relapse into debt.