Kicking off with Futures Market Investing Strategies for Beginners, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

Exploring the world of futures market investing can be both exciting and rewarding for beginners looking to venture into this dynamic market. Understanding the key strategies and concepts is crucial for making informed investment decisions and navigating the complexities of futures trading.

This guide aims to provide a comprehensive overview of essential strategies tailored specifically for those new to futures market investing. From understanding the basics to developing effective investment strategies, beginners will gain valuable insights to kickstart their journey in the futures market.

Importance of Futures Market Investing

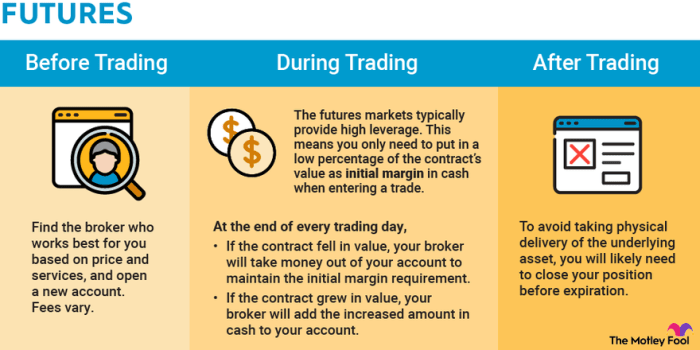

Investing in the futures market can offer a range of benefits for investors looking to diversify their portfolios and potentially maximize returns. Unlike traditional stock market investing, futures market investing involves trading contracts that obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price on a specified future date.

This can provide opportunities for investors to hedge against price fluctuations, speculate on price movements, and access a wide range of asset classes.

Benefits of Investing in the Futures Market

- Diversification:Futures markets offer exposure to a variety of asset classes, including commodities, stocks, and currencies, allowing investors to diversify their portfolios and reduce risk.

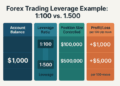

- Leverage:Futures contracts typically require a fraction of the total contract value as margin, allowing investors to control a larger position with a relatively small amount of capital.

- Hedging:Investors can use futures contracts to hedge against price fluctuations in the underlying asset, reducing the risk of losses in their investment portfolio.

Risks and Rewards of Futures Market Investing

- Potential Rewards:Futures market investing can offer high potential returns due to the leverage involved, allowing investors to amplify gains on their investments.

- Potential Risks:However, the use of leverage in futures trading also magnifies the potential for losses, making it important for investors to carefully manage risk and have a solid understanding of the market dynamics.

- Volatility:Futures markets can be highly volatile, with prices fluctuating rapidly based on a variety of factors such as economic data, geopolitical events, and market sentiment.

Understanding Futures Contracts

Futures contracts are financial agreements to buy or sell a specific asset at a predetermined price on a specified future date. These contracts are standardized and traded on futures exchanges, providing investors with a way to hedge against price fluctuations or speculate on the future price of commodities, currencies, stocks, or other assets.

Role of Futures Exchanges

Futures exchanges act as intermediaries, facilitating the trading of futures contracts between buyers and sellers. They provide a centralized marketplace where these contracts can be bought and sold. Examples of popular futures exchanges include the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

Types of Assets Traded

- Commodities: Futures contracts are commonly used to trade commodities such as oil, gold, wheat, and coffee.

- Stock Indices: Investors can also trade futures contracts based on stock market indices like the S&P 500 or Dow Jones Industrial Average.

- Currencies: Futures contracts for major currencies like the US dollar, Euro, and Japanese Yen are actively traded in the foreign exchange market.

- Interest Rates: Futures contracts allow investors to speculate on the future direction of interest rates, such as the Fed Funds Rate.

Developing a Futures Market Investment Strategy

When it comes to investing in the futures market, having a well-thought-out investment strategy is crucial for success. This involves a careful consideration of various factors to maximize potential returns while managing risks effectively.

Setting Investment Goals and Risk Tolerance Levels

- Begin by clearly defining your investment goals, whether it's capital appreciation, income generation, or hedging against price fluctuations.

- Evaluate your risk tolerance level to determine how much volatility you can stomach in your investment portfolio.

- Align your investment goals with your risk tolerance to create a balanced and realistic investment strategy.

Importance of Diversification in a Futures Market Investment Portfolio

Diversification is a key component of a successful futures market investment strategy as it helps spread risk across different asset classes and markets.

- Investing in a variety of futures contracts can help minimize the impact of potential losses from any single investment.

- Consider diversifying across different sectors, commodities, and time horizons to reduce correlation risk and enhance portfolio stability.

- Regularly review and rebalance your portfolio to ensure it remains diversified and aligned with your investment objectives.

Technical Analysis in Futures Market Investing

When it comes to futures market investing, technical analysis plays a crucial role in helping traders make informed decisions. By analyzing historical price data, volume, and other market statistics, traders can identify patterns and trends to forecast future price movements.

Common Technical Indicators and Chart Patterns

- Moving Averages: This indicator helps smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements to determine overbought or oversold conditions.

- Bollinger Bands: These bands indicate volatility and potential price breakouts based on standard deviations from a moving average.

- Candlestick Patterns: Patterns like doji, hammer, and engulfing can signal potential reversals or continuations in price movements.

Tips for Beginners

- Start with the Basics: Understand key technical indicators and chart patterns before diving into complex strategies.

- Practice on Demo Accounts: Many trading platforms offer demo accounts for beginners to practice technical analysis without risking real money.

- Keep Learning: Attend webinars, read books, and follow experienced traders to enhance your technical analysis skills.

- Combine with Fundamental Analysis: Consider incorporating fundamental analysis alongside technical analysis for a comprehensive trading strategy.

Fundamental Analysis in Futures Market Investing

Fundamental analysis plays a crucial role in evaluating futures market investments. It involves assessing the intrinsic value of an asset by analyzing various economic factors and indicators that can impact its price in the future. By understanding the underlying economic conditions that drive market movements, investors can make more informed decisions when trading futures contracts.

Role of Economic Indicators and News Events

Fundamental analysis relies on economic indicators and news events to gauge the health of the economy and predict future price movements in the futures market. These indicators can include GDP growth, inflation rates, employment data, consumer spending, and interest rates.

News events such as government policy announcements, geopolitical tensions, and natural disasters can also have a significant impact on futures prices.

- GDP Growth: A strong GDP growth rate can indicate a healthy economy, leading to increased demand for commodities and higher futures prices.

- Inflation Rates: Rising inflation can erode purchasing power, causing investors to seek inflation-hedging assets like commodities, which can drive up futures prices.

- Employment Data: Positive employment data can boost consumer confidence and spending, leading to higher demand for goods and services reflected in futures prices.

Understanding how these economic indicators and news events influence futures prices is essential for developing a successful investment strategy.

Combining Fundamental Analysis with Other Strategies

Fundamental analysis can be combined with technical analysis to create a comprehensive approach to futures market investing. While fundamental analysis focuses on the underlying economic factors, technical analysis involves studying past market data and trends to forecast future price movements.

By integrating both strategies, investors can make more well-rounded decisions based on a thorough analysis of both fundamental and technical factors.

- For example, if fundamental analysis indicates a strong demand for a particular commodity due to economic growth, technical analysis can help determine the optimal entry and exit points for a futures trade based on historical price patterns.

- By combining fundamental analysis with risk management techniques, such as setting stop-loss orders and position sizing, investors can mitigate potential losses and maximize returns in the futures market.

Risk Management Strategies for Futures Market Investing

Risk management is a crucial aspect of futures trading, as it helps investors protect their capital and minimize potential losses. By implementing effective risk management strategies, beginners can navigate the volatile nature of the futures market with more confidence.

Importance of Risk Management in Futures Trading

Effective risk management is essential in futures trading to safeguard capital and reduce the impact of market fluctuations. Without proper risk management strategies in place, investors may expose themselves to significant financial risks.

Different Risk Management Techniques

- Utilizing Stop-Loss Orders: By setting stop-loss orders, investors can automatically sell a futures contract when it reaches a predetermined price level. This helps limit potential losses and manage risk effectively.

- Position Sizing: Determining the appropriate size of each position based on risk tolerance and account size is crucial in risk management. By sizing positions correctly, investors can control the amount of capital at risk in each trade.

Guidance for Beginners in Protecting Capital

- Start with a Clear Risk Management Plan: Establish a risk management plan that includes setting stop-loss orders, defining position sizes, and determining risk-reward ratios before entering any trade.

- Diversify Investments: Spread investments across different asset classes or contracts to reduce overall risk exposure and protect capital from market volatility.

- Continuous Monitoring: Regularly review and adjust risk management strategies based on market conditions and performance to ensure capital protection and risk mitigation.

Final Wrap-Up

In conclusion, mastering futures market investing strategies as a beginner is a journey that requires dedication, continuous learning, and strategic decision-making. By following the tips and insights provided in this guide, beginners can enhance their understanding of the futures market and embark on a path towards financial growth and success.

With a solid foundation in place, beginners can confidently navigate the futures market landscape and make well-informed investment choices to achieve their financial goals.

FAQ Insights

What are the benefits of investing in the futures market?

Investing in the futures market allows for potential higher returns, portfolio diversification, and risk management through hedging strategies.

How does technical analysis help in futures market investing?

Technical analysis involves studying price charts and indicators to forecast future price movements, helping traders make informed trading decisions.

What is the role of fundamental analysis in evaluating futures market investments?

Fundamental analysis focuses on economic factors and news events to assess the intrinsic value of assets, aiding in investment decision-making.

How important is risk management in futures trading?

Risk management is crucial in futures trading to protect capital, minimize losses, and ensure sustainable trading practices for long-term success.