Exploring the ins and outs of using US Tech 100 TradingView for technical analysis, this guide offers a thorough look at the features, setup process, and tools available on the platform. Dive into the world of trading with TradingView and enhance your analytical skills with precision and expertise.

In the following sections, we will delve into the specifics of setting up TradingView for US Tech 100, utilizing various tools for technical analysis, and analyzing charts to make informed predictions.

Overview of US Tech 100 TradingView

US Tech 100 TradingView is a popular platform used by traders and investors to analyze and track the performance of the US Tech 100 index, which includes major technology companies like Apple, Microsoft, and Google.

One of the main features of US Tech 100 TradingView is the ability to access real-time data and advanced charting tools, allowing users to conduct technical analysis effectively. Traders can use various indicators, drawing tools, and chart patterns to make informed decisions about their trades.

Main Features of US Tech 100 TradingView:

- Real-time data: Provides up-to-date information on the US Tech 100 index and its components.

- Advanced charting tools: Allows users to customize charts, add indicators, and analyze price movements.

- Social trading: Enables users to share ideas, strategies, and analysis with the community.

Importance of Using TradingView for Technical Analysis:

TradingView is essential for technical analysis as it offers a wide range of tools and features that help traders identify trends, patterns, and potential entry/exit points in the market. By utilizing these tools, traders can make more informed decisions and improve their trading strategies.

Differences from Other Trading Platforms:

- Community-driven: TradingView allows users to interact with a large community of traders and learn from their insights and analysis.

- Customization: The platform offers extensive customization options for charts and indicators, catering to individual preferences and trading styles.

- Integration: TradingView can be integrated with various brokerage accounts, enabling seamless trading directly from the platform.

Setting up US Tech 100 TradingView

To begin using US Tech 100 TradingView for technical analysis, you need to set up an account and access the relevant data. Here's a step-by-step guide on how to get started:

Creating a TradingView Account

- Visit the TradingView website and click on the "Sign Up" option.

- Enter your email address, create a username, and set a secure password for your account.

- Follow the on-screen instructions to complete the account creation process.

Accessing US Tech 100 Data on TradingView

- Once you have logged into your TradingView account, use the search bar to look for "US Tech 100" or "NASDAQ 100."

- Click on the relevant option to access the real-time data and charts for US Tech 100.

- You can customize the chart settings and indicators based on your analysis requirements.

Customization Options for Technical Analysis

- TradingView offers a wide range of customization options for technical analysis, including different chart types, timeframes, and drawing tools.

- You can add indicators like Moving Averages, RSI, MACD, and Bollinger Bands to enhance your analysis.

- Experiment with different settings and layouts to create a personalized trading setup that suits your trading style.

Utilizing Tools for Technical Analysis

When it comes to technical analysis on TradingView for US Tech 100, there are several tools available to help traders make informed decisions. These tools can include indicators, drawing tools, and other features that provide valuable insights into market trends and potential price movements.

Indicators for Technical Analysis

- Moving Averages: Moving averages are commonly used to identify trends and potential entry or exit points in the market. Traders can set different periods for moving averages to smooth out price data and get a clearer picture of the trend.

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. Traders often use RSI to determine overbought or oversold conditions in the market, which can signal potential reversals.

Drawing Tools for Trend Analysis

Drawing tools play a crucial role in analyzing trends on TradingView. Traders can use tools like trendlines, channels, and Fibonacci retracement levels to identify key support and resistance areas, as well as patterns that may indicate future price movements. These tools help traders visualize price action and make more informed trading decisions.

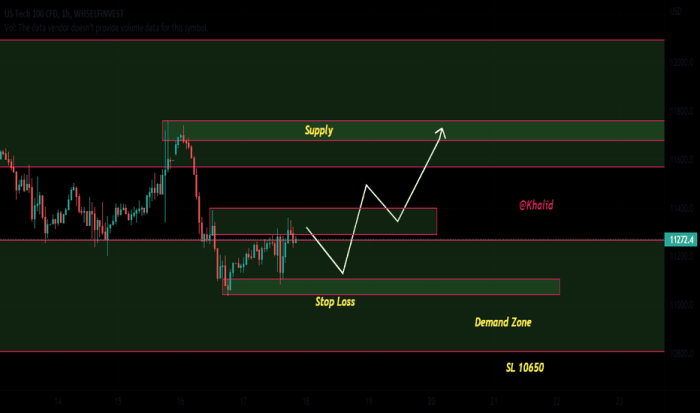

Analyzing US Tech 100 Charts

When it comes to analyzing US Tech 100 charts, it is crucial to understand various elements that can help in making informed trading decisions. Candlestick patterns, support and resistance levels, and chart patterns all play a significant role in technical analysis for the US Tech 100 index.

Interpreting Candlestick Patterns

Candlestick patterns are a popular tool used by traders to analyze price movements. Each candlestick represents a specific time period and shows the opening, closing, high, and low prices within that period. By interpreting these patterns, traders can gain insights into market sentiment and potential price direction changes.

For example, a Doji candlestick may indicate indecision in the market, while a Hammer or Shooting Star candlestick could signal a potential reversal.

Significance of Support and Resistance Levels

Support and resistance levels are key areas on a chart where the price tends to bounce or reverse. Support acts as a floor, preventing the price from falling further, while resistance acts as a ceiling, capping the price's upward movement.

Identifying these levels can help traders determine entry and exit points, as well as potential price targets. Breakouts above resistance or below support can signal significant price movements.

Using Chart Patterns for Price Predictions

Chart patterns, such as head and shoulders, triangles, and flags, can provide valuable information about potential price movements. For instance, a symmetrical triangle pattern may suggest a period of consolidation before a breakout, while a head and shoulders pattern could indicate a trend reversal.

By recognizing these patterns and understanding their implications, traders can anticipate future price movements and adjust their trading strategies accordingly.

Outcome Summary

In conclusion, mastering the use of US Tech 100 TradingView for technical analysis can open up a world of possibilities in the realm of trading. With the knowledge gained from this guide, you are equipped to navigate the complexities of the market with confidence and strategic insight.

FAQ Section

What are the main features of US Tech 100 TradingView?

The main features include advanced charting tools, technical analysis indicators, and the ability to customize charts to suit individual preferences.

How do I access US Tech 100 data on TradingView?

You can access the data by searching for 'US Tech 100' in the symbol search bar on TradingView.

Why are drawing tools important for trend analysis on TradingView?

Drawing tools help identify trends and patterns on charts, aiding in making informed trading decisions based on technical analysis.