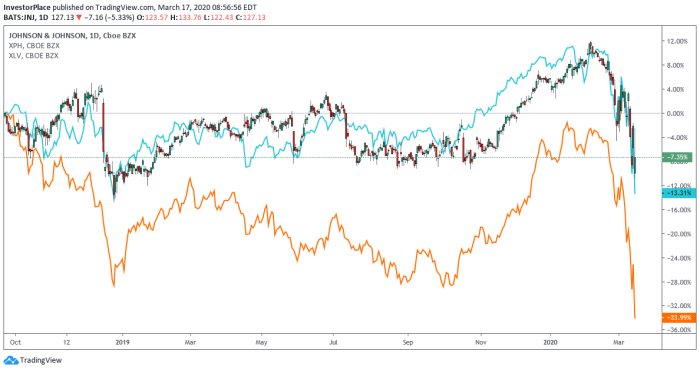

Starting off with JNJ Stock Valuation Compared to Healthcare Peers, this opening paragraph aims to engage readers with a detailed overview of the topic.

Exploring the intricacies of stock valuation in the healthcare sector, this discussion delves into key factors influencing JNJ's standing among its peers.

JNJ Stock Valuation Overview

Johnson & Johnson (JNJ) stock valuation is calculated primarily using the discounted cash flow (DCF) method, which takes into account the company's future cash flows and discounts them back to present value. This method considers factors such as revenue growth, profit margins, and cost of capital to determine the intrinsic value of the stock.

Key Factors Influencing JNJ Stock Valuation

- Revenue Growth: The consistent growth in revenue is a key factor influencing JNJ's stock valuation. Higher revenue indicates a strong business performance and potential for future earnings.

- Profit Margins: JNJ's profit margins play a crucial role in determining its valuation. Higher margins suggest efficient operations and better profitability, positively impacting the stock price.

- Product Pipeline: The strength of JNJ's product pipeline and innovation capabilities can influence its valuation. New and successful product launches can drive future growth and enhance stock value.

- Regulatory Environment: Changes in regulations or legal issues can impact JNJ's valuation. Adverse regulatory actions or lawsuits may lead to a decline in stock price.

Importance of Understanding Stock Valuation for Investors

Investors need to understand stock valuation to make informed investment decisions. By analyzing a company's valuation, investors can determine whether a stock is undervalued, overvalued, or fairly priced. This knowledge helps investors identify potential opportunities and risks, allowing them to build a well-balanced investment portfolio based on sound financial analysis.

Comparison with Healthcare Peers

When comparing JNJ's stock valuation to its healthcare peers, it is important to consider various factors that contribute to the differences in valuation among healthcare companies. Let's take a closer look at some major healthcare peers of JNJ and analyze how their stock valuations compare.

Major Healthcare Peers of JNJ

- Abbott Laboratories (ABT)

- Pfizer Inc. (PFE)

- Merck & Co., Inc. (MRK)

- Novartis AG (NVS)

Factors Contributing to Differences in Stock Valuation

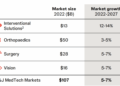

One of the key factors that contribute to differences in stock valuation among healthcare companies is their product pipeline and innovation capabilities. Companies with a strong portfolio of innovative drugs and medical devices tend to have higher valuations due to the potential for revenue growth.Additionally, market share and competitive positioning play a significant role in determining stock valuation.

Companies that dominate specific healthcare segments or have a strong competitive advantage are often valued higher by investors.Moreover, financial performance and growth prospects also impact stock valuation. Healthcare companies that demonstrate consistent revenue growth, profitability, and strong financial health are typically rewarded with higher valuations in the stock market.Overall, it is essential to consider a combination of factors, including product innovation, market share, competitive positioning, and financial performance, when comparing JNJ's stock valuation to its healthcare peers.

Financial Performance Analysis

When analyzing the financial performance of Johnson & Johnson (JNJ) in recent years, it is crucial to consider key metrics such as revenue, profit margin, and other financial indicators. Comparing these metrics with those of its healthcare peers can provide valuable insights into how JNJ stands in the industry and how its financial performance affects its stock valuation.

Revenue Comparison

One of the essential financial metrics to consider is revenue. Johnson & Johnson has consistently shown strong revenue growth over the years, with a diversified product portfolio spanning pharmaceuticals, medical devices, and consumer health products. This diversification has helped JNJ maintain steady revenue streams even during economic downturns

Profit Margin Analysis

Another crucial metric to assess is the profit margin. Johnson & Johnson has demonstrated healthy profit margins compared to its healthcare peers. This indicates that JNJ is effectively managing costs and generating profits efficiently across its business segments. A high profit margin is a positive sign for investors, as it shows that the company is operating efficiently and effectively.

Financial Performance Impact on Stock Valuation

The financial performance of a company like Johnson & Johnson directly impacts its stock valuation in the healthcare sector. Strong revenue growth, healthy profit margins, and overall financial stability can attract investors and positively influence the stock price. Conversely, a decline in financial performance may lead to a decrease in stock valuation as investors may perceive the company as less competitive or less stable compared to its peers.

Growth Prospects and Market Positioning

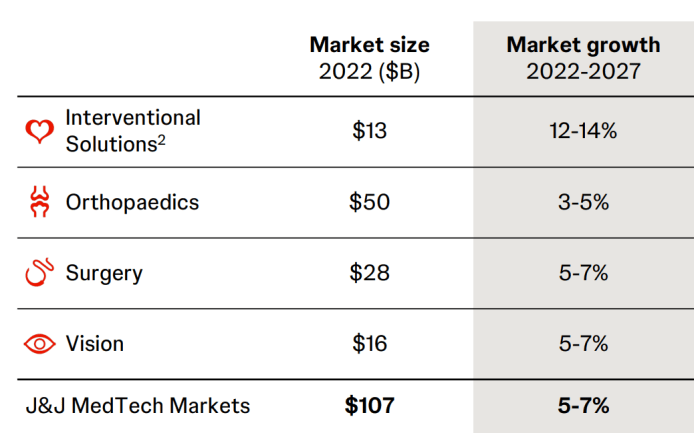

In the competitive healthcare industry, growth prospects and market positioning play a crucial role in determining the success of a company like JNJ. Let's delve deeper into JNJ's growth prospects and market positioning compared to its peers.

Growth Prospects

JNJ has a strong track record of innovation and research in the healthcare sector, which positions it well for future growth. The company invests heavily in R&D to develop new products and technologies that address unmet medical needs. This focus on innovation not only enhances JNJ's product portfolio but also ensures its relevance in a rapidly evolving market.

- JNJ's pharmaceutical segment continues to drive growth with a pipeline of promising drugs in various therapeutic areas. This diversification reduces the risk associated with dependency on a single product.

- The company's consumer health and medical devices segments also offer growth opportunities, especially in emerging markets where demand for healthcare products is rising.

- JNJ's strategic acquisitions and partnerships further bolster its growth prospects by expanding its market reach and capabilities.

Market Positioning

In terms of market positioning, JNJ stands out among its peers due to its strong brand reputation, global presence, and diversified product portfolio. The company's focus on quality, safety, and efficacy of its products has earned it the trust of healthcare professionals and consumers worldwide.

- JNJ's market share in key therapeutic areas such as oncology, immunology, and cardiovascular diseases is a testament to its leadership position in the industry.

- The company's commitment to sustainability and corporate social responsibility also enhances its brand image and resonates with socially conscious consumers.

- Competitors may struggle to replicate JNJ's market positioning due to its long-standing relationships with healthcare providers and patients, built on a legacy of integrity and reliability.

Growth prospects and market positioning are key drivers of stock valuation, as investors assess a company's potential for future earnings growth and competitive advantage in the market.

Final Wrap-Up

Concluding our discussion on JNJ Stock Valuation Compared to Healthcare Peers, it's evident that a deep understanding of stock valuation is crucial for investors navigating the healthcare industry.

FAQ Resource

How is JNJ's stock valuation calculated?

JNJ's stock valuation is typically calculated based on various financial metrics such as earnings per share, price-to-earnings ratio, and discounted cash flow analysis.

Which major healthcare peers are compared to JNJ?

Some of JNJ's major healthcare peers for comparison include Pfizer, Merck, and Abbott Laboratories.

How does financial performance impact stock valuation in the healthcare sector?

Strong financial performance, including factors like revenue growth and profit margins, can positively influence a healthcare company's stock valuation.