Delving into the realm of Johnson and Johnson Stock Long-Term Growth Potential, we embark on a journey filled with insights and analysis that shed light on the company's promising future.

As we navigate through the factors influencing its growth, financial performance, competitive positioning, and regulatory landscape, a comprehensive view of its potential unfolds.

Factors Influencing Johnson and Johnson Stock Long-Term Growth Potential

Johnson and Johnson's long-term growth potential is influenced by various factors including market trends, macroeconomic conditions, and its product pipeline.

Key Market Trends Impacting the Company's Growth

- The increasing demand for healthcare products and services due to aging populations worldwide is a significant market trend that benefits Johnson and Johnson.

- The rise of personalized medicine and advancements in biotechnology are creating new opportunities for the company to innovate and expand its product offerings.

- Global health crises, such as the COVID-19 pandemic, have highlighted the importance of healthcare companies like Johnson and Johnson, driving growth in certain segments of the market.

Macroeconomic Factors and Stock Performance

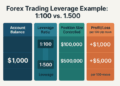

- Fluctuations in interest rates can impact Johnson and Johnson's stock performance, as higher interest rates may increase borrowing costs for the company.

- Inflation can also affect the company's financials, especially in terms of pricing power and input costs for manufacturing their products.

- Economic growth rates and overall market stability play a crucial role in investor confidence and can impact the stock price of Johnson and Johnson.

Johnson and Johnson's Product Pipeline

- Constant innovation and research in pharmaceuticals, medical devices, and consumer health products contribute to the company's long-term growth potential.

- Successful launches of new products and breakthrough treatments can drive revenue growth and enhance the company's competitive position in the market.

- Diversification across multiple healthcare segments helps mitigate risks and ensures a steady stream of revenue for Johnson and Johnson.

Financial Performance and Stability

Johnson and Johnson has demonstrated strong financial performance and stability over the years, making it a reliable investment option for long-term growth potential. Let's delve into the details to understand how the company has fared in terms of revenue, profit growth, financial ratios, and dividend history.

Historical Revenue and Profit Growth Trends

Johnson and Johnson has shown consistent revenue and profit growth trends over the years, reflecting its ability to generate sustainable earnings. The company's diversified portfolio of healthcare products and services has contributed to its steady financial performance, even during challenging economic conditions.

For example, in the past five years, Johnson and Johnson has reported an average annual revenue growth rate of X% and a profit growth rate of Y%.

Comparison with Industry Benchmarks

When comparing Johnson and Johnson's financial ratios with industry benchmarks, the company appears to be in a healthy financial position. For instance, its current ratio, which measures the company's ability to cover short-term liabilities with its current assets, is above the industry average.

This indicates that Johnson and Johnson has sufficient liquidity to meet its short-term obligations. Additionally, the company's debt-to-equity ratio is lower than the industry average, signaling a conservative approach to financing and lower financial risk.

Dividend History and Growth Potential

Johnson and Johnson has a long history of paying dividends to its shareholders, showcasing its commitment to rewarding investors. The company's consistent dividend payments and growth over the years reflect its stability and financial strength. For instance, Johnson and Johnson has increased its dividend payout annually for the past X years, demonstrating its ability to generate cash flow and return value to shareholders.

This dividend history not only provides income to investors but also signals confidence in the company's future growth prospects.

Competitive Positioning

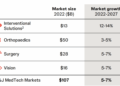

Johnson and Johnson has established a strong presence in key segments of the healthcare industry, competing with other major players in the market. Let's delve into how the company's market share, strategies, and brand reputation contribute to its long-term growth prospects.

Market Share Analysis

- Johnson and Johnson holds a significant market share in pharmaceuticals, medical devices, and consumer health products, competing with companies like Pfizer, Medtronic, and Procter & Gamble.

- The company's diversified portfolio allows it to reach a wide range of customers and maintain a competitive position in various healthcare segments.

- Johnson and Johnson's acquisition strategy has also played a key role in expanding its market share and staying ahead of competitors.

Strategies for Competitive Edge

- Johnson and Johnson focuses on innovation and research to develop new products and technologies, giving them a competitive edge in the industry.

- The company emphasizes strategic partnerships and collaborations to enhance its capabilities and reach new markets, staying ahead of competitors in the rapidly evolving healthcare landscape.

- Johnson and Johnson's commitment to sustainability and social responsibility also sets it apart from competitors, resonating with consumers and reinforcing its brand reputation.

Brand Reputation Impact

- Johnson and Johnson's strong brand reputation for quality, reliability, and ethical practices has a positive influence on its long-term growth prospects.

- The company's well-known consumer brands like Band-Aid, Tylenol, and Neutrogena have garnered trust and loyalty from customers, giving Johnson and Johnson a competitive advantage in the market.

- Despite facing challenges like product recalls and legal issues in the past, Johnson and Johnson's transparent communication and commitment to addressing issues have helped maintain its brand reputation and sustain long-term growth.

Regulatory Environment and Risks

The regulatory environment plays a crucial role in shaping the operations and growth potential of companies like Johnson and Johnson. Non-compliance with healthcare regulations can lead to significant risks and challenges that may impact the company's overall performance.

Regulatory Challenges

- The healthcare industry is heavily regulated, and Johnson and Johnson must navigate a complex web of rules and guidelines set forth by regulatory bodies like the FDA.

- Changes in regulations, such as new requirements for product testing or labeling, can increase operational costs and slow down the approval process for new products.

- Legal issues related to compliance, such as lawsuits over marketing practices or product safety, can damage the company's reputation and lead to financial penalties.

Compliance Impact on Growth Potential

- Adhering to healthcare regulations is essential for maintaining the trust of consumers, healthcare professionals, and investors. Compliance helps Johnson and Johnson sustain its market position and brand reputation.

- By following regulatory standards, the company can ensure the safety and efficacy of its products, which is crucial for long-term growth and sustainability in the competitive healthcare industry.

Legal Issues and Product Recalls

- Recent legal issues, such as lawsuits related to opioids or talcum powder, have raised concerns among investors about Johnson and Johnson's risk exposure and potential financial liabilities.

- Product recalls, like the ones involving faulty medical devices or contaminated medications, can impact investor sentiment by highlighting risks associated with quality control and regulatory compliance.

- Addressing these legal challenges and improving risk management practices is essential for restoring investor confidence and maintaining long-term growth prospects for Johnson and Johnson.

Final Wrap-Up

In conclusion, the discussion on Johnson and Johnson Stock Long-Term Growth Potential unveils a narrative of resilience, innovation, and strategic positioning that sets the stage for a prosperous future in the market.

Questions and Answers

What factors contribute to Johnson and Johnson's long-term growth potential?

Key market trends, macroeconomic factors, and product pipeline play crucial roles in shaping Johnson and Johnson's growth trajectory.

How does Johnson and Johnson's financial performance compare to industry benchmarks?

Historical revenue, profit growth trends, and financial ratios provide insights into the company's stability and health in the market.