Delving into Revenue Based Financing for Startups and SMEs, this article aims to shed light on a unique funding approach that is gaining traction in the business world. As entrepreneurs seek innovative ways to finance their ventures, RBF offers a compelling alternative to traditional funding methods.

Let's explore the ins and outs of this financing model and how it can benefit emerging businesses.

As we navigate through the intricacies of Revenue Based Financing, we will uncover its key features, eligibility criteria, application process, and its impact on business growth. By the end of this discussion, you will have a comprehensive understanding of how RBF can revolutionize the financial landscape for startups and SMEs.

What is Revenue Based Financing (RBF)?

Revenue Based Financing (RBF) is a type of funding mechanism where a company receives capital in exchange for a percentage of its future revenues. Unlike traditional financing options such as loans or equity investments, RBF does not require business owners to give up ownership stakes or take on debt.

How RBF Works in Practice for Startups and SMEs

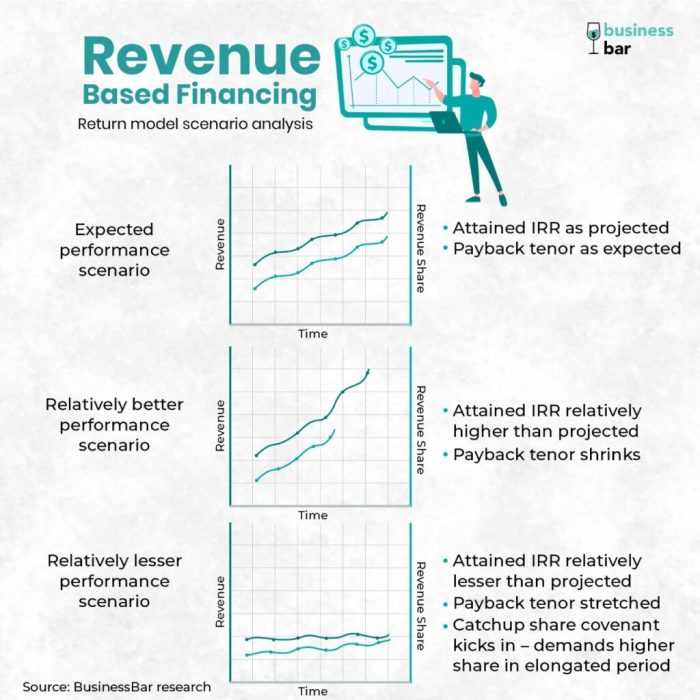

RBF providers typically offer funding to startups and small to medium-sized enterprises (SMEs) based on their projected revenues. In return, the RBF provider receives a percentage of the company's monthly revenues until a predetermined amount is repaid, along with a multiple of the initial investment.

This repayment structure is often tied to revenue performance, making it a flexible option for businesses with fluctuating income streams.

- RBF allows startups and SMEs to access capital without diluting ownership or taking on traditional debt.

- It provides a non-dilutive financing option for companies that may not qualify for traditional loans or venture capital.

- Companies with strong revenue growth potential can benefit from RBF as it aligns the interests of the business owner and the investor.

Benefits and Drawbacks of Using RBF as a Funding Mechanism

RBF offers several advantages, such as providing quick access to capital, allowing companies to retain control and ownership, and offering flexible repayment terms based on revenue performance. However, there are also drawbacks to consider, including the potential for higher overall costs compared to traditional financing options, as the repayment multiple can result in a significant return for the RBF provider.

- Benefits of RBF:

- Non-dilutive funding option

- Flexible repayment terms tied to revenue performance

- Allows companies to retain control and ownership

- Drawbacks of RBF:

- Potential for higher overall costs due to repayment multiple

- Less suitable for companies with inconsistent or unpredictable revenue streams

- May limit future financing options due to revenue sharing agreements

Key Features of Revenue Based Financing

Revenue Based Financing (RBF) offers unique features that make it an attractive option for startups and SMEs looking for funding. Unlike traditional loans, RBF aligns the interests of investors and businesses, providing flexibility in repayment terms.

Flexibility of Repayment Terms

RBF allows businesses to repay the funding based on a percentage of their monthly revenue. This flexible structure ensures that payments are manageable, especially during periods of fluctuating cash flow. Unlike fixed monthly payments in traditional loans, RBF adjusts based on the business's performance, easing financial strain.

Alignment of Interests

RBF aligns the interests of investors and businesses by linking repayment to revenue. Investors benefit from a share of the business's revenue, incentivizing them to support growth and success. This alignment ensures that investors are motivated to help the business thrive, as their returns are directly tied to the company's performance.

Eligibility Criteria for Revenue Based Financing

Revenue Based Financing (RBF) is a unique funding option for startups and SMEs that offers flexibility and growth opportunities. To qualify for RBF, businesses need to meet certain eligibility criteria that focus on revenue projections and growth potential rather than traditional metrics like credit history and collateral.

Revenue Projections and Growth Potential

- Businesses seeking RBF must have strong revenue projections that demonstrate the potential for growth and profitability. Lenders are interested in businesses that show a clear path to increasing revenue over time.

- Growth potential is a key factor in securing RBF, as lenders are looking for businesses with the ability to scale and generate higher returns in the future.

- Startups and SMEs with innovative business models or products that have the potential to disrupt the market are often favored by RBF providers.

Credit History and Collateral Requirements

- RBF does not require a strong credit history or collateral, unlike traditional loans. Lenders focus more on the business's revenue and growth potential rather than past financial performance.

- Startups and SMEs with limited credit history or lack of valuable assets can still qualify for RBF based on their revenue-generating potential.

- This flexibility in credit history and collateral requirements makes RBF an attractive option for businesses that may not qualify for traditional bank loans.

Application Process for Revenue Based Financing

When applying for Revenue Based Financing (RBF) as a startup or SME, the process typically involves the following steps:

Step 1: Initial Application

- Submit an application detailing your business model, financial projections, and revenue history.

- Provide information on how much funding you require and how it will be utilized.

Step 2: Due Diligence

- Investors will conduct thorough due diligence to assess the viability and growth potential of your business.

- They will analyze your revenue streams, market positioning, and overall business strategy.

Step 3: Term Sheet Negotiation

- Once your application is approved, you will receive a term sheet outlining the terms and conditions of the RBF agreement.

- Negotiate the terms with the investors to ensure they align with your business goals.

Step 4: Funding Disbursement

- Upon agreement on the terms, the funds will be disbursed to your business to support growth and expansion.

- Regular payments based on a percentage of your revenue will commence as per the agreed-upon terms.

Investor Considerations for RBF Applications

- Investors look for businesses with strong revenue-generating potential and a proven track record of consistent revenue.

- They assess the scalability of the business model and the ability to generate returns on their investment.

- Investors also evaluate the risk factors associated with the business and its industry.

Common Challenges in RBF Application Process

- Difficulty in providing accurate revenue projections that meet investor expectations.

- Negotiating terms that balance the needs of the business with the investor's return expectations.

- Ensuring transparency and clear communication throughout the due diligence process.

Impact of Revenue Based Financing on Growth

Revenue Based Financing (RBF) can have a significant impact on the growth trajectory of startups and SMEs by providing them with the necessary capital to scale their operations without the pressure of fixed monthly payments. Unlike traditional loans, RBF allows businesses to repay the funding based on a percentage of their revenue, which aligns the interests of the investors with those of the entrepreneurs.

Success Stories of Businesses Utilizing RBF

- A tech startup was able to expand its product line and enter new markets after securing RBF funding, leading to a substantial increase in revenue.

- An e-commerce SME utilized RBF to invest in marketing strategies, resulting in a higher customer acquisition rate and improved brand visibility.

- A service-based business scaled its operations and improved its infrastructure with RBF funding, leading to enhanced efficiency and profitability.

Long-Term Implications of RBF on Financial Health

RBF can have a positive long-term impact on the financial health of a business by providing a flexible repayment structure that adjusts with revenue fluctuations, reducing the risk of default.

RBF also allows businesses to retain ownership and control over their operations, unlike traditional equity financing, which can dilute ownership. This leads to a healthier balance sheet and sustainable growth over time.

Final Summary

In conclusion, Revenue Based Financing presents a promising avenue for startups and SMEs to secure funding without the constraints of traditional loans. By prioritizing revenue-sharing over fixed payments, RBF aligns the interests of investors and entrepreneurs, fostering mutual growth and success.

As the business world continues to evolve, embracing innovative financing solutions like RBF can pave the way for sustainable growth and prosperity.

User Queries

What is Revenue Based Financing (RBF)?

Revenue Based Financing is a funding model where businesses receive capital in exchange for a percentage of their future revenue until a predetermined amount is repaid.

How does RBF differ from traditional financing options?

RBF offers flexible repayment terms based on revenue, unlike traditional loans that require fixed payments regardless of business performance.

What are the key features that make RBF attractive to startups and SMEs?

RBF provides non-dilutive funding, aligns investor interests with business success, and adapts repayment to revenue fluctuations.

What are the typical eligibility criteria for RBF?

Startups and SMEs with stable revenue streams and growth potential are often eligible for RBF, focusing less on credit history and collateral.

How can RBF impact the growth trajectory of startups and SMEs?

RBF can fuel growth by providing flexible capital that scales with revenue, allowing businesses to expand without the pressure of fixed payments.